The CashFlow Quadrant by Robert Kiyosaki is the most important topic you need to know about Finance. I feel like every person in the world should know about it. You need to master it in order to become a successful self employed person or a successful business owner. Because everybody is gonna be working for money or paycheck in their life, it's important to know about money and finance. And the CashFlow Quadrant is the basic fundamental of it.

If you don't know Robert Kiyosaki, he is known for his famous book “Rich Dad Poor Dad”. Rich Dad Poor Dad is the No.1 Personal Finance Book of All-Time. In this book the writer advocates the importance of financial literacy, financial independence and building wealth through investing in assets, real estate investing, starting and owning businesses, as well as increasing one's financial intelligence. He also has a book called The CashFlow Quadrant.

A lot of people are always asking me all the time, how to become an investor, how to invest $1000 or $10k, what stocks do they need to buy, where to invest their money. And I have always told them like if you don't have a $100k minimum, you are not ready to invest and you are not an investor. If you want to know why, I have already explained it in-dept in my Trading vs Investor blog. It's a big topic and I recommend you to check it out.

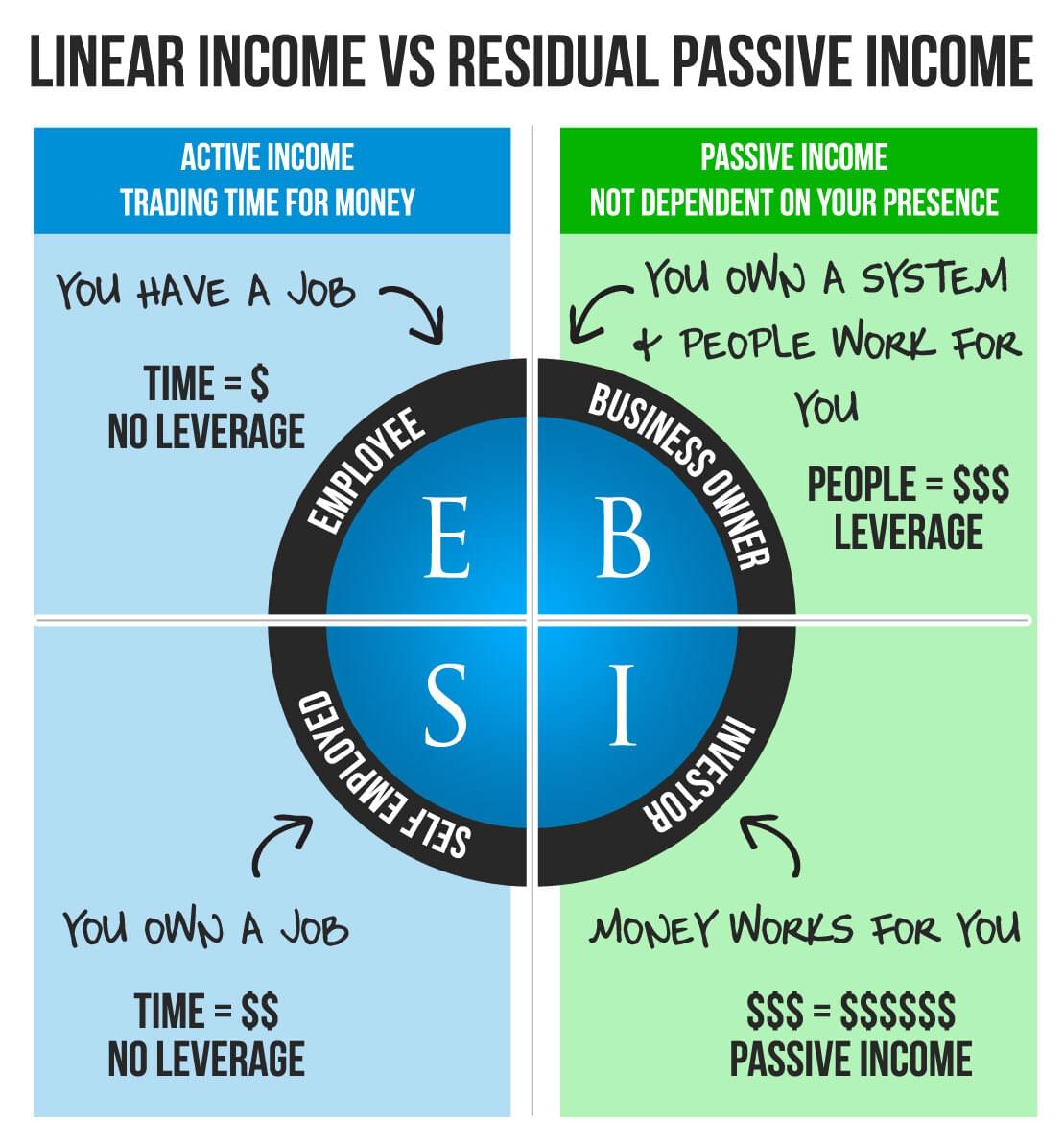

The CashFlow Quadrant will reveal why some people work less, earn more, pay less in taxes, and feel more financially secure than others. It is simply a matter of knowing which quadrant to work from and when. I think you have already wondered in your childhood, “What is the difference between an employee and a business owner?”. You’re gonna see the major differences between the two if you understand the CashFlow Quadrant. This is gonna be an eye opener for many of you guys.

So now let's dive into what's the CashFlow Quadrant.